Non-manufacturing labor costs, such as office or administrative wages, are period costs. Non-manufacturing labor costs are debited to an expense account for wages or salaries. Once a product is sold, it is no longer an asset in the organization’s possession.

Selling and Administrative Costs

- Companies generally use job cost systems when they can identify separate products or when they produce goods to meet a customer’s particular needs.

- In this case, we can make the journal entry to record the indirect labor to the cost pool of manufacturing overhead with the debit of the manufacturing overhead account and the credit of the labor cost account.

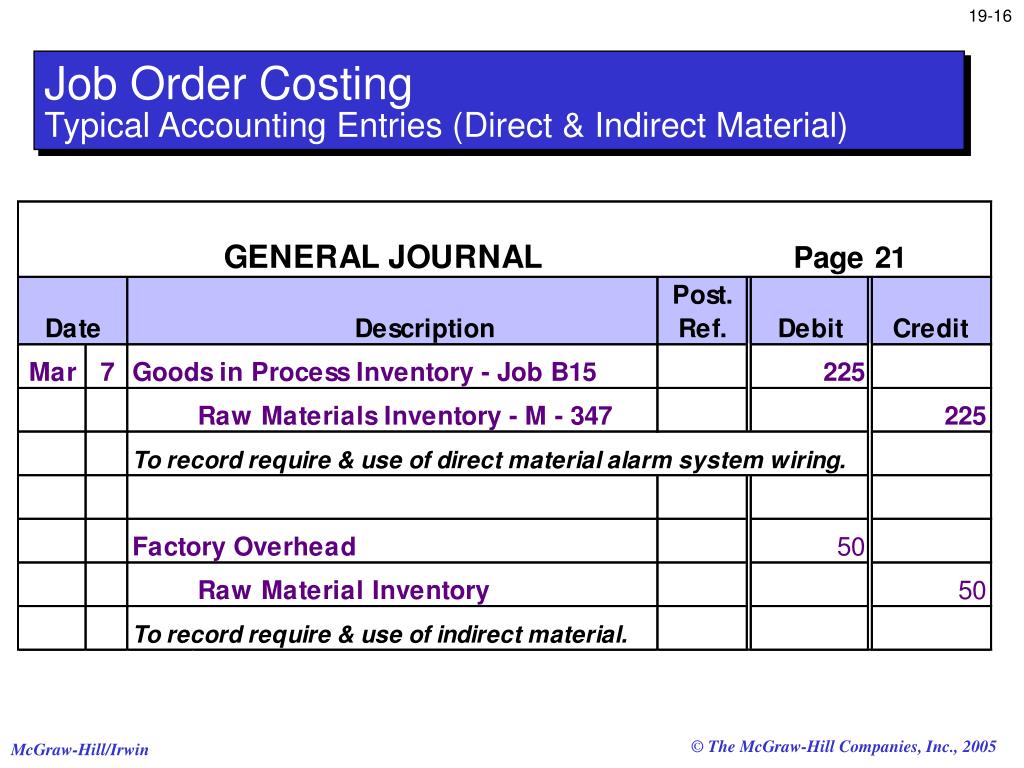

- When materials are requisitioned for manufacturing, all materials are credited out of the Raw Materials inventory account.

- Job16 had 875 machine-hours so we would charge overhead of $1,750 (850machine-hours x $2 per machine-hour).

Creative Printers uses job costing.Creative Printers keeps track of the time and materials (mostlypaper) used on each job. In a journal entry, we will do entries for eachletter labeled in the chart — where the arrow is pointing TO is ourdebit and where the arrow is coming FROM is our credit. Here is avideo discussion of job cost journal entries and then we will do anexample. Each inventory account starts with a beginning balance at the start of an accounting period. During the period, if additional inventory is purchased, the new inventory amount is added to the beginning balance to calculate the total inventory available for use or sale.

4 Tracing the Flow of Costs in Job Order

Unlike direct material or direct labor, it not easy to apply manufacturing overhead costs directly to jobs. Manufacturing overhead costs are not incurred uniformly and many of these costs are not directly traceable to the jobs in process. For example, an organization might pay property taxes on the production plant twice a year. These property taxes are considered indirect manufacturing costs and should be applied to all jobs produced during the year and not just the jobs in process at the time the taxes are paid. In some cases, organizations choose not to use a single, organization-wide predetermined manufacturing overhead rate to apply manufacturing overhead to the products or services produced.

Cost of goods sold

Process costing is the optimal system to use when the production process is continuous and when it is difficult to trace a particular input cost to an individual product. Process costing systems assign costs to each department as the costs are incurred. The costs to produce one unit are calculated, based on the information from the production department. Therefore, the focus of process costing systems is on measuring and assigning the conversion costs to the proper department in order to best determine the cost of individual units. Regardless of the costing method used (job order costing, process costing, or another method), manufacturing companies are generally similar in their organizational structure and have a similar flow of goods through production. The diagram in Figure 8.1 shows a partial organizational chart for sign manufacturer Dinosaur Vinyl.

Tracking the Flow with Selected T-Accounts

In the fabrication department, laborers pour composite materials into custom carved molds. In finishing, the widgets are put on an automated production line where they are heated and coated. Job order costing is a method of cost accumulation that is used for items or batches of items that are unique – that is, each customer’s order is different.

The ending inventory balance at the end of the accounting period can then be subtracted from the inventory available for use, and the total represents the cost of the inventory used during the period. For example, assume that a homeowner wants to have a custom deck added to her home. Also assume that in order to fit her lot’s topography and her anticipated uses for the addition, she needs a uniquely designed deck. Her contractor will design the deck, price the necessary components (in this case, the direct materials, direct labor, and overhead), and construct it. The processes to solve the following scenario are demonstrated in Video Illustration 2-5 below. The manufacturing process has two departments—fabrication and finishing.

Similar to indirect materials, indirect labor cannot be directly assigned to specific jobs but they are related to the production operation as a whole. Hence, these indirect labor costs will also need to be recorded in the cost pool of manufacturing overhead before they are further transferred to the work in process account. Manufacturing overhead is applied to jobs using a predetermined manufacturing overhead rate.

Assets are items that an organization owns that have future value to the organization. The inventory accounts commonly used in a job-order costing system include the Raw Materials account, Manufacturing Overhead account, Work in Process account, and Finished Goods account. Product costs, or manufacturing costs, flow through these accounts until the product is complete.

When a home is finished, the company has a record of the actual costs incurred to build each house. Job-order costing is an accounting system used to assign manufacturing costs to the products or services that an organization produces. Product costs, or inventory costs, include the costs for direct material, direct labor, and manufacturing overhead.

Typically, as goods are being produced, additional jobs are being started and finished, and the work in process inventory includes unit costs of jobs still in production at the end of the accounting period. At the end of the accounting cycle, there will be jobs that remain unfinished in the production cycle, and these represent the work in process inventory. The costs on the job order cost sheet help reconcile the cost of the items transferred to the finished goods inventory and the cost of the work in process inventory. Prior comparison of job costing with process costing to the sale of the product, separating production costs and assigning them to the product results in these costs remaining with the inventory. Until they are sold, the costs incurred are reflected in an assortment of inventory accounts, such as raw materials inventory, work in process inventory, and finished goods inventory. One factor that can complicate the choice between job order costing and process costing is the growth of automation in the production process, which typically is accompanied by a reduction in direct labor.

Connect With Us

Discover the essence of holistic living at

Om Kalyanam Wellness Resort, nestled

in the majestic Doon Valley, where luxury

and wellness intertwine seamlessly.

Important Links

- The Boulevard

- Dev Mahasabha

- Wellness Centre

- Tatvamayee Meditation

- Accommodation

- Helipad at Resort

Contact Us

Mussoorie Bypass

- info@omkalyanam.com

Leave a Reply